TXSV: LIFT | OTCQX: LIFFF | FRA: WS0

Disclosure: Owners, members, directors and employees of Katusa Research have/may have stock or option position in any of the companies mentioned: LIFT. Katusa Research receives compensation for this publication and has a business relationship with any company whose stock(s) is/are mentioned in this article.

This content was reviewed and approved by LIFT POWER.

IN THIS REPORT

This Lithium Explorer Is About to Have Its "Nvidia Moment"

Companies don't exist in a vacuum. Nvidia had been producing computer chips for more than 20 years until the AI revolution turned it into the most valuable company on the planet.

History is about to repeat itself with this dirt-cheap lithium company…

Li-FT Power (TSXV: LIFT / OTCQX: LIFFF)

In this report:

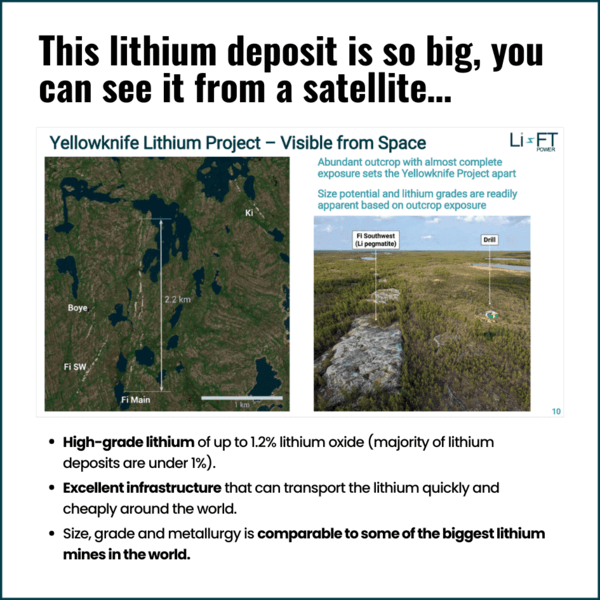

- The only natural lithium deposit you can see from a satellite

- Why investors should be ecstatic about low lithium prices

- The EV innovation cycle has entered the “mass adoption phase” in 31 countries – and counting…

In 2022, Nvidia had been producing computer chips for more than 20 years.[i]

It was known and loved among video game players and computer geeks.

But among the broad public, few have ever heard about the company.

Until the winter of 2022, when an unknown software company released chatGPT[ii] – the first retail application of artificial intelligence for the everyday computer user.

It was the beginning of one of the biggest tech trends since the creation of the Internet.

And it turned Nvidia from an “also-ran” to the most valuable company in the world with a $3 trillion market value.[iii]

The stock went up 2,927% in just five years. [iv]

Before AI, Nvidia already had the product. But it took time for the market to develop for Nvidia to become truly successful.

The lithium market is about to enter a “mass profit cycle” – which is why you should consider a lithium explorer like Li-FT Power (TSXV: LIFT / OTCQX: LIFFF)

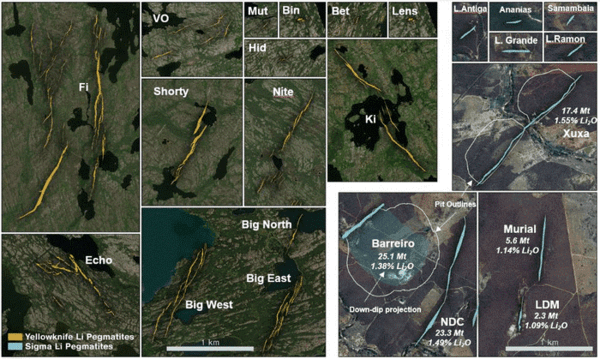

Li-FT Power owns a monster lithium deposit in Northern Canada called the Yellowknife Lithium Project.

Now, this deposit is not a secret.

In fact…

So why has no one mined it yet?

For the same reason that Nvidia was a tech company like any other for more than 20 years.

The market didn’t need much lithium… Until the electric car arrived and created a shortage of secure long-life lithium supply in politically stable region

Elon Musk once said that lithium was “the new oil.” [v]

Of course, as CEO of the most famous electric car company – Tesla – you can argue that Elon Musk is biased when it comes to lithium.

But it’s hard to disagree…

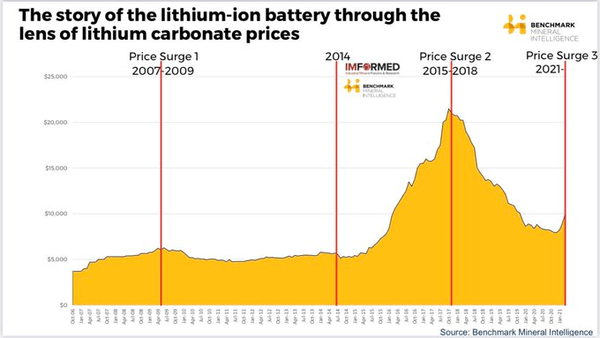

Since Musk released the first electric vehicle, the Tesla Roadster, in 2008[vi], the lithium price has gone up 788%.[vii]

More than 40 million electric vehicles have been sold to date, each with a lithium ion battery.[ix]

Lithium is in the middle of one of the most significant resource bull markets of the 21st Century

Today, the price hovers around $12,500 per metric ton, far below the $37,000 average price in 2022[x], or its all-time high of $90,800 in November 2022.[xi]

Does that mean the lithium hype is over?

Not at all.

In fact, a new study using data from the International Energy Agency says that prices could soar 1,500% by 2050.[xii]

It may sound counter-intuitive, but the lithium price has dropped partly because EVs are now becoming mainstream. They’re “old news.” The media has moved on to newer and shinier things.

Short-term investors have found new trends to latch on to for short-term gains.

And the International Energy Agency still predicts that…

50% of the world’s new cars will be EVs with lithium batteries by 2035 – [xiv]

So why isn’t there more hype?

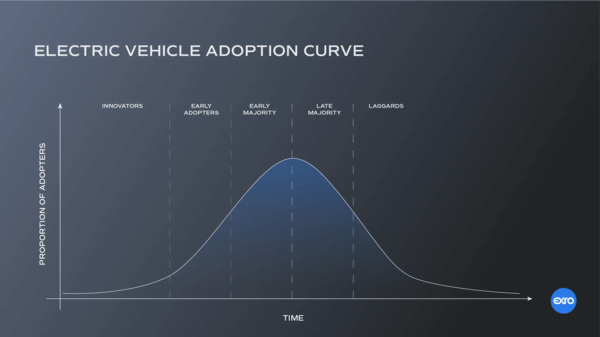

If you’ve ever invested in a mining stock, a commodity or a tech stock, you might be familiar with the Diffusion of Innovations Theory.[xv]

Put simply, every invention is going through five stages after its initial creation.

PHASE 1:

First, the innovation phase. This is when die-hard fans of the inventor, or ultra-curious people, try out the invention. There might be some hype, but it’s limited to a small circle of supporters.

PHASE 2:

Then, the early adoption phase. Now the product is adding thought leaders and influencers to their customer base. These people create the first media hype, which can lead to incredible early gains. This happened to electric cars in 2022.

EVs are now entering the most lucrative phase of the innovation cycle

PHASE 3:

Once an invention proves to work well, it moves into the third phase of the cycle, the early majority adoption. These customers don’t buy to impress others with their innovative products. They buy for practical reasons, the quality of the product or the way it improves their lives.

And this is when the biggest profit momentum is built. Instead of a short-term hype that drives the stock up and down, companies now bring in real profits that are realized into sustained stock gains. This is the phase electric cars are entering now.

Similar thing happened with oil…

Petroleum was used industrially and for lamps in homes for decades before the first car was invented.

[xvii] In fact, John D. Rockefeller became the first oil baron in the world in the late 19th Century, when people were still riding horses and buggies.

But it wasn’t until Henry Ford developed his famous Ford assembly line in 1913[xviii] that oil became a mass commodity.

Suddenly, oil companies started sprouting across the world’s oil fields like weeds after a rainstorm.

Now, instead of having just one big oil baron, the world has Exxon Mobil, Shell, BP, Chevron, Aramco and a massive and powerful organization of oil companies in the Middle East, OPEC.

What if you could have invested in a company like Chevron when it was a small-time petroleum producer in California?

Now you have the chance to get in early on a global trend with a small lithium company like Li-FT Power (LIFT.TSXV / LIFFF.OTCQX)

PHASE 4:

Once an innovation trend is established, it enters into the mass adoption phase, when the rest of the public can’t resist but jump on the bandwagon.

PHASE 5:

And finally, the “laggards”, the final holdouts of this trend, have no choice but to buy into the product, either because the incentives have become too strong, or because the infrastructure has completely transformed and phased out their old product.

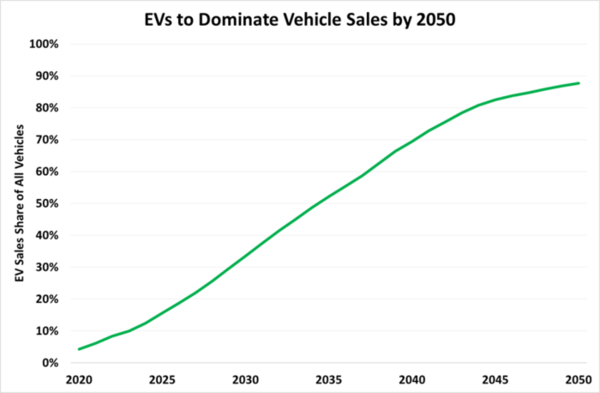

Experts predict electric cars will reach the final phase around 2050.

Gas-powered vehicles will be phased out entirely and finally banned from being sold. Gas stations will disappear and be replaced by electric charging stations. Those with the last gas cars will now either get their gas from special gas distributors or buy an electric car to have more convenience.

[xix]And every single one of those EVs needs lithium to create the car’s lifeline – the battery.

An electric car needs about 16 pounds of lithium per battery.[xx]

You might have heard rumblings about alternatives to lithium batteries that could upstage the chemical in the EV revolution.

Make no mistake…

Researchers have been working on all kinds of innovations around alternative fuels for cars.

But as long as lithium remains an abundant chemical on the planet, there is simply no need to invent alternatives.

What fueled the shortage panic of 2022 was a lack of production capacity, not a lack of lithium deposits

The acceleration of the EV trend took many by surprise. Especially because it was fueled by world governments eager to offer incentives for buying an EV to satisfy their green energy agendas.

Lithium producers simply couldn’t keep up with this extremely high demand.

It takes years to set up a new lithium mining operation. There are tests that can take years, regulation hurdles, financing needs to be secured…

Even if you extract lithium using the other popular method, called “brining,” this process will still take you 12-18 months until the lithium ready to use.[xxi]

Electric car manufacturers didn’t have that time. Customers wanted to have their new cars immediately and take advantage of the generous tax breaks from their governments.

Now every manufacturer was vying for the small amount of available lithium, which drove up the price to unseen heights.

At that point, lithium prices are expected to stabilize.

Which is why you should consider a lithium explorer like Li-FT Power (TSXV: LIFT / OTCQX: LIFFF) before prices go up

Prices are cheap for now. The deposits are there.

If you wait for prices to go up before you jump in, you could miss out on the biggest gains.

This monster lithium deposit will not stay cheap for long.

Li-FT’s a company bursting with lithium potential.

Literally coming out of the ground.

Li-FT recently finished drilling at Yellowknife.

Why hasn’t Yellowknife been drilled for lithium if it could be one of the greatest deposits in North America?

Extracting any resource… from gold to copper to lithium takes:

- Time to permit and develop the mine site

- Money to do so

Companies like ExxonMobil and individuals barely touched Yellowknife for almost a century as lithium wasn’t as profitable to get out of the ground.

Only recently have EV sales picked up… lithium prices soared and then stabilized and the demand for lithium-ion batteries taken off.

It’s only now… as we face geopolitical risks and coming lithium shortages does it finally makes sense to put more shovels into the ground.

That’s the opportunity Li-FT Power and its founders see.

Over 50% of the outstanding shares of Li-FT Power are owned by the founders and early investors.

Early Li-FT investors poured in as much as $15 million dollars into the company to acquire the Yellowknife Project and start defining how much lithium is in the ground.

That money hasn’t gone to pay out ‘bonuses’ or waste.

Francis, the CEO, is plowing most of the cash into fast-tracking Yellowknife by drilling to determine HOW MUCH lithium is there.

Remember, this deposit has lithium containing rock that can be seen on the surface.

Now, it’s drilling down 200-300 meters and determining how big this project really is.

“We’re hitting on 80-90% of our drill holes,” the CEO says.

Meaning, 80-90% of drill tests locate more lithium.

- Mid-2024, Li-FT has completed drilling and drilled down to 300m.

When you hear about car companies partnering up with mines now:

- Ford pre-purchased one-third of the output of a lithium mine in 2022

- GM invested over $650 million bucks into a lithium mine in 2020

- Volkswagen is seeking to create what former CEO Herbert Diess has called a “full ecosystem of suppliers from lithium extraction to the assembly of batteries” in Spain

Car companies are biting their nails due to shrinking lithium supply-to-demand.

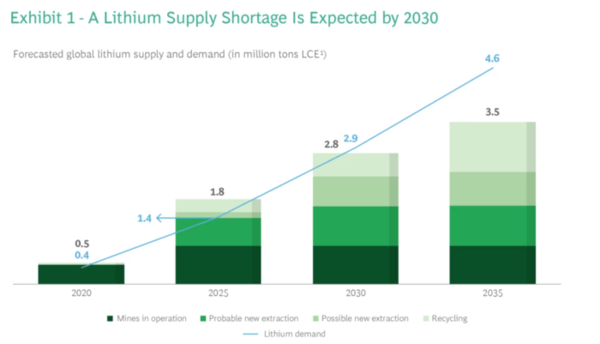

We’ll need 78 new mines by 2035 to accommodate total demand

But few mines are under development, and existing mines are not scaling up lithium production.

Also, lithium mines take 10+ years to bring online. So if the mine is not already under development, it’s too late.

Which is why massive shortfalls are already being predicted.

Under the best case scenario, the lithium shortage in three years will be as much as the entire demand was in 2022.

To avoid the impending crisis, EV manufacturers are taking matters into their own hands. In a rare move, they’re getting involved in lithium mining itself.

What’s unfolding is an escalating, no-holds-barred brawl for lithium supply.

- Consider Volvo, which is talking with the biggest mining companies in the world about buying a stake in their operations. Not for a profit, but just to have access to lithium.

- Volkswagen’s CEO, Scott Keogh, echoes this sentiment: “We are not going to become a mining company. But certainly, we will get significantly closer.”

- Or Ford, which pre-purchased 33% of the lithium output of a new mine in Nevada last year.

- A few months after that, GM invested $650 million in a lithium mine—also in Nevada.

GM Director of Purchasing Tanya Skilton predicts that the industry will be divided into winners and losers: Companies with minerals for “electrified dreams” will succeed.

The rest are toast.

It’s after feasibility, this type of investor interest really picks up both with the stock…

AND the potential vendors who desperately need more high-grade lithium.

Why?

Once Li-FT discovers how much lithium they can get and the way to extract it economically… companies and investors start watering at the mouth.

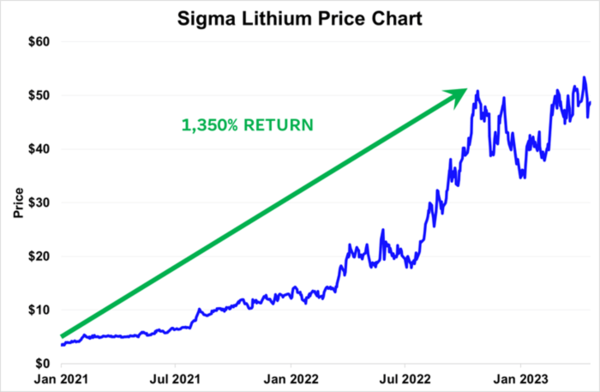

An example is Tesla was rumored to be in talks to buy Sigma Lithium… the massive lithium project in South America for around $3-4 billion.

That company kept updating their feasibility and reserve size to be bigger and bigger… Tesla was interested to pounce.

How big is the potential lithium motherlode inside Yellowknife?

NOTE: Modelling a deposit has a lot of variables, and risk. And that’s the job of seasoned analysts and qualified persons to determine.

Tesla was interested in buying Sigma Lithium, as mentioned. Today, Sigma is a $4 billion dollar lithium company in Brazil.

Their entire business centers around their one lithium project, Grota do Cirilo.

The mine’s already up, running and producing as they started working on it in 2012.

Sigma’s Grota do Cirilo, is estimated to hold between 85 and 110 million metric tonnes of lithium in their mine.

What about Yellowknife?

According to Francis, the CEO…

He and his team are more than halfway through drilling to determine the actual tonnage.

Sigma is further along and now producing up to $450 million in free cash flow from their lithium output.

Sigma’s stock skyrocketed over 1,350% as lithium demand and prices soared… Of course, past returns are no guarantee of future returns. These results are not indicative of results at Li-FT property.

Taking a further look…

LIFT’s Yellowknife lithium deposits are in yellow, and Sigma’s Grota do Cirilo deposits are in green, both at the same scale on these maps.

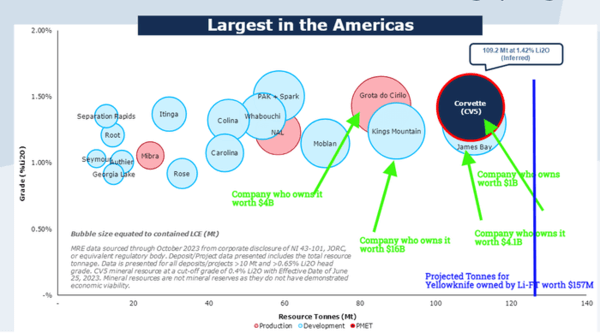

Let’s look at another major lithium discovery (again, this is picking the superstar assets)… Patriot Battery Metals…

- 2.5 years ago, they were worth around $10M. Today, they’re a $590 million dollar company but haven’t pulled an ounce of lithium out of the ground yet.

Patriot Battery Metals project is called, Corvette.

And it’s currently heralded as one of the largest lithium mining deposits in the Americas.

They show 109 million metric tonnes of lithium ore.

The project is still years from producing lithium revenue… worth over $1 billion… they’ve simply defined how much lithium they have in the ground.

Li-FT Power aims to have a resource estimate done in the next 8 months and will be able to share their final numbers.

If >100 million metric tonnes proves correct (that “IF” is THE high-risk with this)…

Li-FT Power could end up with a significant lithium deposit in the Americas.

The top 4 lithium projects in the Americas are owned by billion dollar companies as of this writing

One large owner, Albemarle, is worth over $16 billion. They own multiple projects globally.

Take a look:

Yellowknife has the potential to surpass the size of these billion-dollar sites, including its neighbor, Patriot Battery Metals.

Meaning, two of the largest deposits in North America are quietly tucked away in Canada.

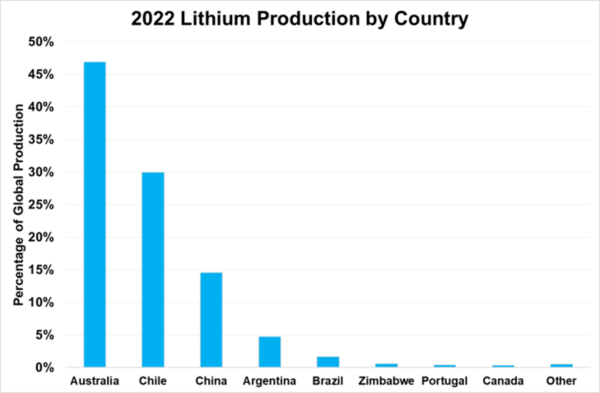

Yet, at the moment, Canada is a rounding error on the total lithium producers in the world.

Canada is a sleeping giant in lithium production.

Canada is a sleeping giant in lithium production.

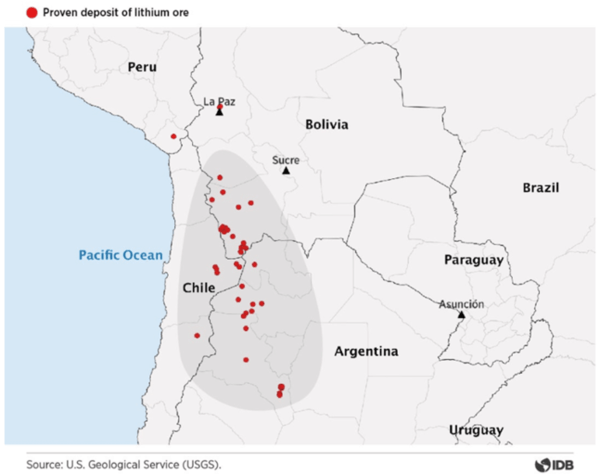

Australia leads the pack in lithium production by a wide margin followed by members of the “Lithium Triangle”, Chile and Argentina. Then, of course, China.

Canada is not even at 3% while Australia reigns at over 46%.

It’s not a shock if Canada begins making strides higher, especially in the mining space.

- Canada is already a top 5 producer of uranium, diamonds, gold, platinum, titanium, and other resource metals. Mining is in its DNA.

In Canada, thanks to the Ice Age ending only 25,000 years ago, the lithium deposits are easier to get to (cheaper to drill) and not as ‘damaged.’ The glaciers also “polished” the landscape making beautiful, pristine deposits at the surface in areas like Yellowknife.

Not only that…

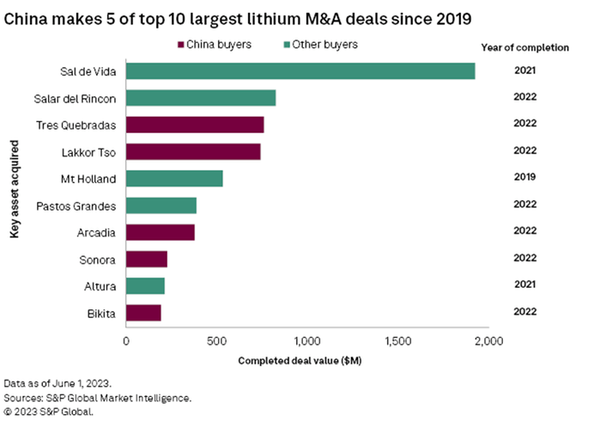

Many Canadian suppliers are not affiliated with China

China is a major geopolitical concern in the lithium space. A big reason being they got to the lithium first. Their quest for more EVs before global adoption meant they snatched up mines all over the world.

China itself produces only 17% of the world’s raw lithium. But it has managed to wrap its tentacles around every corner of the lithium market.

It even has the lithium refining market cornered: 65% of the world’s lithium chemicals are produced in China.

For example, Australia produces about half of the world’s raw lithium—but it’s almost all owned by China:

- A Chinese lithium company owns a large stake (~25%) in Greenbushes, the Australian lithium reserve that is the largest in the world,

- The second-largest lithium reserve in the world, also in Australia, is underwritten by Ganfeng Lithium… a Chinese company.

Nearly 60% of the world’s known reserves of lithium can be found inside a triangle that intersects the borders of three countries – Chile, Argentina, and Bolivia. (aka the “Lithium Triangle”)

The “Lithium Triangle” holds most of the lithium reserves… and China owns a large chunk of the Ganfeng Lithium paid $4 billion to become the second-largest shareholder in SQM, the largest lithium producer in Chile.

And in 2021, Chinese companies bought three major lithium mines in Argentina in deals worth $1.3 billion.

Most countries are trying to get out from the stranglehold of China’s grasp on the lithium market.

China’s main gig is that they own over 60% of the lithium processing capacity. Bloomberg projects they own up to “80%”. Which is quite alarming…

That’s on top of owning the actual lithium in the ground inside multiple countries.

The battle for lithium comes down to access to the lithium-ion batteries.

That’s why the US is also seeking alternative lithium supplies.

We need more lithium-ion batteries to power electric vehicles.

An electric car battery has between 30 and 60 kilos of lithium. It’s estimated that by 2034, the US alone will need 500,000 metric tons of unrefined lithium a year for EV production.

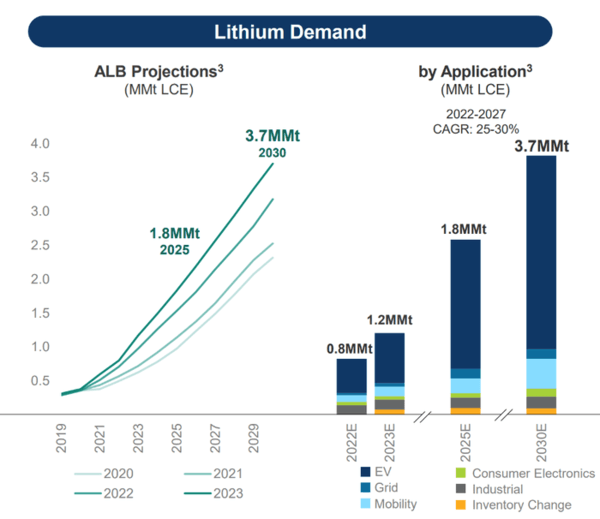

That’s more than the global supply was in 2020. And by 2030, Albemarle, the world’s largest lithium producer is projecting that 3.7 M metric tonnes of lithium will be needed.

That’s a lot of lithium needed…

By mid-century, some experts project EVs will be nearly 100% of the market supply for vehicles.

Boston Consulting Group predicts electric battery-powered vehicles will surpass combustion engine vehicle sales as soon as 2028.

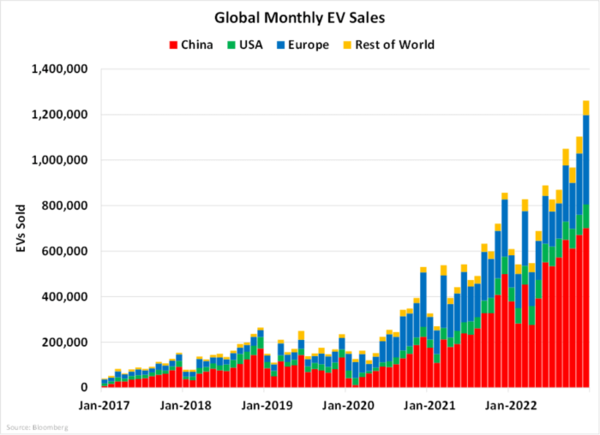

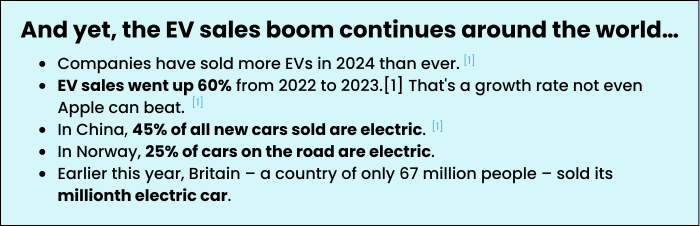

EV demand has picked up in just the last two years.

EV demand has picked up in just the last two years.

Whether you believe gas powered cars are on their way out or not… there’s no denying EV sales are shooting upwards at the moment. Everywhere you turn in North America, there’s a Tesla driving by.

And the numbers in China are breaking new records…

If the U.S. meets its 2030 target, there will be more than 48 million EVs on the road in just seven years.

But it’s not just the US trading in gas for lithium-powered electrics…

Europeans just started buying a ton more EVs in 2021.

EV sales have tripled in just three years.

EV sales have tripled in just three years.

China beat other countries to the ‘lithium punch’ early because they suck up more supply of EVs than anyone.

More EVs on the road = more lithium required.

To create one, singular lithium-ion battery to power a Tesla, you must process 25,000 pounds of brine for the lithium!

More is needed.

The International Energy Agency, an organization that tracks world energy usage, says:

Demand for LITHIUM is growing faster than demand for any other metal or mineral

They estimate that the global demand for lithium will increase more than tenfold by 2030, and potentially 50 times greater by 2040.

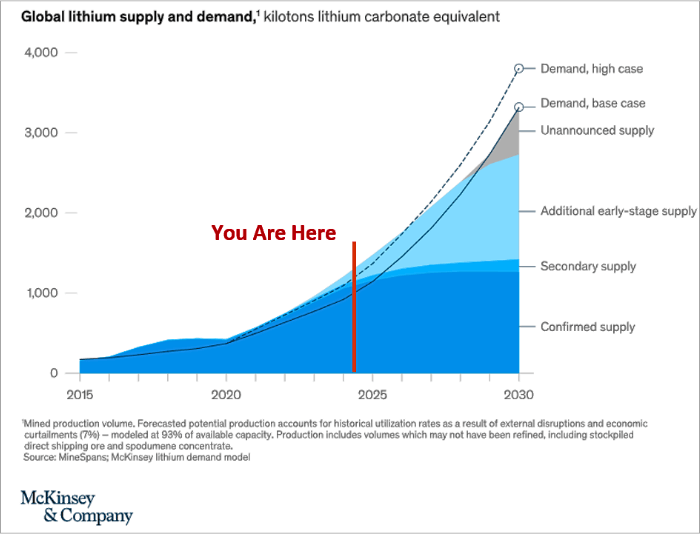

Check out where the demand graph is at the moment…

We’re in the early stages of lithium demand.

We’re in the early stages of lithium demand.

Meaning, experts predict a near 4X increase in lithium demand. 73% of that today comes from EVs. Another block is energy storage.

Keith Phillips, CEO of Piedmont Lithium, projects we need “40X more lithium by the end of this decade.”

That may be overstating, but either way… the supply crunch is set to begin as early as 2025. And the gap will only widen as time passes.

We need more lithium being produced.

Well, there are large players out there.

The biggest in the world own projects in the China-heavy “Lithium Triangle.”

However, getting the product out of the ground and scaling it is a problem.

The problem?

Big-time companies like Albemarle aren’t hard-rock lithium mining… they use a technique called brining.

- Brining is a process where… instead of chipping away at rock and pulling out the lithium…

Brining pumps ungodly amounts of water into lithium deposits… extracts the solution… then dries out the water to get the lithium salt remaining.

Here’s the issue…

The brining evaporating cycle takes 2 years to complete!

In Hard Rock lithium mining, you can pull the product out and it’s commercial-ready 6 weeks later.

Yellowknife has hard-rock lithium sitting on the surface ready to be processed. Little to no water evaporating is required.

You can’t scale brining operations without more land and tonnes and tonnes of more water.

In Chile, brining has caused severe droughts. In Northern Chile, an entire river was dried out due to water extraction and evaporation. “Rivers and lakes have disappeared,” one local told the news.

To meet soaring demand…

We need more hard-rock lithium miners. And with many countries turning their backs on Chinese operations…

Canada has another opportunity to shine in the mining space.

The lithium Project that could be at the center of it all?

It’s called Yellowknife, as mentioned. A Project you can see from Google Maps for yourself, it’s that obvious!

Yellowknife’s owned by Li-FT Power… a three-year-old lithium mining company.

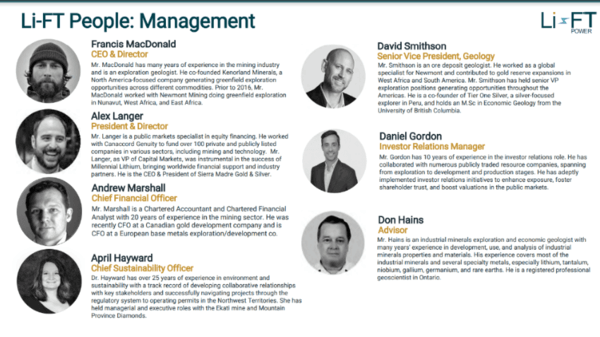

Francis MacDonald, the CEO, has put together an expert team with multiple geologists and environmental officers.

A top tier team for a top tier lithium asset. Insiders own 50% of the outstanding shares.

A top tier team for a top tier lithium asset. Insiders own 50% of the outstanding shares.

Currently, the company is valued around $198 million, as of this writing. They hold $18 million just in cash.

The stock trades for around $2 under the ticker symbol: LIFFF:USOTC.

The goal is to continue to develop the Yellowknife project to become one of the top deposits in not just the Americas… but also the world.

Insiders still own 50% of the stock and aren’t selling. Shares only went public in May 2023.

Lithium prices currently sit at multi-year lows.

As we see a supply crunch with demand skyrocketing, there’s no telling how long lithium prices will stay this low.

This low lithium price will discourage new lithium miners to develop.

Meaning, if competitors don’t start now, they won’t be extracting any new lithium before 2030. That could exacerbate the supply problem even further.

By then, it’s too late even if lithium prices rebound.

An investor is better to position themselves before lithium prices go up again. (there’s no telling when that may be).

Investing in Li-FT Power at just $4 is an easy way to gain exposure to lithium, but also enjoy watching the potential unfold.

- Their next major milestone for investors is finishing their drilling in early 2024… then a feasibility study by mid-2025.

Consider Li-FT Power (OTCMKTS: LIFFF) as a potential value play in the lithium mining space

As a bonus:

Li-FT Power also owns four other projects in Canada.

- Cali – acquired with Yellowknife near the Yukon border

- Rupert – located near the James Bay region of Quebec

- Pontax – located also near the James Bay region

- Moyenne – accessed via helicopter, also located in James Bay

All 4 of these ‘bonus’ assets are in exploration. Most funding is going towards Yellowknife.

[i] https://www.nvidia.com/en-us/about-nvidia/corporate-timeline/ First GPU unit created in 1999, before that it was only software

[ii] https://www.forbes.com/sites/bernardmarr/2023/05/19/a-short-history-of-chatgpt-how-we-got-to-where-we-are-today/

[iii] https://www.cnbc.com/2024/06/22/nvidia-is-little-known-despite-topping-3-trillion-in-market-cap.html

[iv] https://finance.yahoo.com/quote/NVDA/chart/

[v] https://x.com/sdmoores/status/1547288110467145728

[vi] https://www.tesla.com/elon-musk#:~:text=The%20first%20Tesla%20product%2C%20the,SUV%2C%20which%20launched%20in%202015.

[vii] https://www.statista.com/statistics/606350/battery-grade-lithium-carbonate-price/ From $5,180 in 2010 to $46,000 in 2023 = 788%

[viii] Image source (will need to recreate with other data source): https://x.com/sdmoores/status/1382962935140651008

[ix] https://ourworldindata.org/electric-car-sales

[x] https://www.dailymetalprice.com/metalpricecharts.php?c=li&u=kg&d=240 [xi] https://tradingeconomics.com/commodity/lithium 660,000 CNY = $90,800

[xii] https://smallcaps.com.au/new-study-lithium-demand-soar-2050/

[xiii] Sales growth stats: https://www.iea.org/reports/global-ev-outlook-2023/trends-in-electric-light-duty-vehicles electric car sales caught up in February and March 2023, standing nearly 60% above sales in February 2022 and more than 25% above sales in March 2022 China stat: https://www.iea.org/news/the-worlds-electric-car-fleet-continues-to-grow-strongly-with-2024-sales-set-to-reach-17-million In 2024, electric cars sales in China are projected to leap to about 10 million, accounting for about 45% of all car sales in the country. Norway stat: https://www.exro.com/industry-insights/early-adopters-of-electric-vehicles-the-ev-adoption-curve Britain stat: https://www.automotiveworld.com/articles/evs-arent-dead-so-why-are-we-in-mourning/#:~:text=EVs%20are%20certainly%20not%20dead,enough%20to%20strengthen%20the%20industry.

[xiv] https://www.forbes.com/sites/energyinnovation/2024/05/19/the-vibes-lie-electric-vehicles-accelerate-toward-50-of-global-sales/#

[xv] https://www.exro.com/industry-insights/early-adopters-of-electric-vehicles-the-ev-adoption-curve

[xvi] Image source: https://www.exro.com/industry-insights/early-adopters-of-electric-vehicles-the-ev-adoption-curve

[xvii] Image source: https://corporate.ford.com/articles/history/moving-assembly-line.html

[xviii] https://www.history.com/this-day-in-history/fords-assembly-line-starts-rolling

[xix] Image source (different one can be used): https://www.shutterstock.com/image-photo/ev-battery-module-automotive-industry-on-2333774641

[xx] https://www.popularmechanics.com/science/energy/a42417327/lithium-supply-batteries-electric-vehicles/

[xxi] https://spectrum.ieee.org/direct-lithium The process takes 12 to 18 months, leaving behind piles of waste containing other metals.

DISCLOSURES/DISCLAIMER

IMPORTANT DISCLAIMER: Katusa Research, as a publisher, is not a broker, investment advisor, or financial advisor in any jurisdiction. Please do not rely on the information presented by Katusa Research as personal investment advice. If you need personal investment advice, kindly reach out to a qualified and registered broker, investment advisor, or financial advisor. The communications from Katusa Research should not form the basis of your investment decisions. Examples we provide regarding share price increases related to specific companies are based on randomly selected time periods and should not be taken as an indicator or predictor of future stock prices for those companies.

Li-FT Power Corp has reviewed and sponsored this article. The information in this newsletter does not constitute an offer to sell or a solicitation of an offer to buy any securities of a corporation or entity, including U.S. Traded Securities or U.S. Quoted Securities, in the United States or to U.S. Persons. Securities may not be offered or sold in the United States except in compliance with the registration requirements of the Securities Act and applicable U.S. state securities laws or pursuant to an exemption therefrom. Any public offering of securities in the United States may only be made by means of a prospectus containing detailed information about the corporation or entity and its management as well as financial statements. No securities regulatory authority in the United States has either approved or disapproved of the contents of any newsletter.

Katusa Research nor any employee of Katusa Research is not registered with the United States Securities and Exchange Commission (the “SEC”): as a “broker-dealer” under the Exchange Act, as an “investment adviser” under the Investment Advisers Act of 1940, or in any other capacity. He is also not registered with any state securities commission or authority as a broker-dealer or investment advisor or in any other capacity.

HIGHLY BIASED: In our role, we aim to highlight specific companies for your further investigation; however, these are not stock recommendations, nor do they constitute an offer or sale of the referenced securities. Katusa Research has received cash compensation from Li-FT Power Corp in the amount of one million two hundred fifty thousand dollars as reported in LiFT's May 28, 2024 news release and is thus extremely biased. Members of Katusa Research also own shares in Li-FT Power and stand to benefit with changes in the share price.

It is crucial that you conduct your own research prior to investing. This includes reading the companies' SEDAR and SEC filings, press releases, and risk disclosures.

The information contained in our profiles is based on data provided by the company, extracted from SEDAR and SEC filings, company websites, and other publicly available sources.

HIGH RISK: The securities issued by the companies we feature should be seen as high risk; if you choose to invest, despite these warnings, you may lose your entire investment. You must be aware of the risks and be willing to accept them in order to invest in financial instruments, including stocks, options, and futures.

NOT PROFESSIONAL ADVICE: By reading this, you agree to all of the following: You understand this to be an expression of opinions and NOT professional advice. You are solely responsible for the use of any content and hold Katusa Research, and all partners, members, and affiliates harmless in any event or claim. While Katusa Research strives to provide accurate and reliable information sourced from believed-to-be trustworthy sources, we cannot guarantee the accuracy or reliability of the information. The information provided reflects conditions as they are at the moment of writing and not at any future date. Katusa Research is not obligated to update, correct, or revise the information post-publication.

FORWARD-LOOKING STATEMENTS: Certain information presented may contain or be considered forward-looking statements. Such statements involve known and unknown risks, uncertainties and other factors which may cause actual results or events to differ materially from those anticipated in these statements. There can be no assurance that any such statements will prove to be accurate, and readers should not place undue reliance on such information. Katusa Research does not undertake any obligations to update information presented, or to ensure that such information remains current and accurate.

Disclosure: Owners, members, directors and employees of Katusa Research have/may have stock or option position in any of the companies mentioned: LIFT. Katusaresearch.com receives compensation for this publication and has a business relationship with any company whose stock(s) is/are mentioned in this article. This content was reviewed and approved by LIFT POWER. Please read our Full RISKS and DISCLOSURE here.

[xiii]

[xiii] [xvi]

[xvi]